Venture Global Faces Investor Scrutiny Over IPO Valuation

Funding | Jan 23, 2025 | Zawya

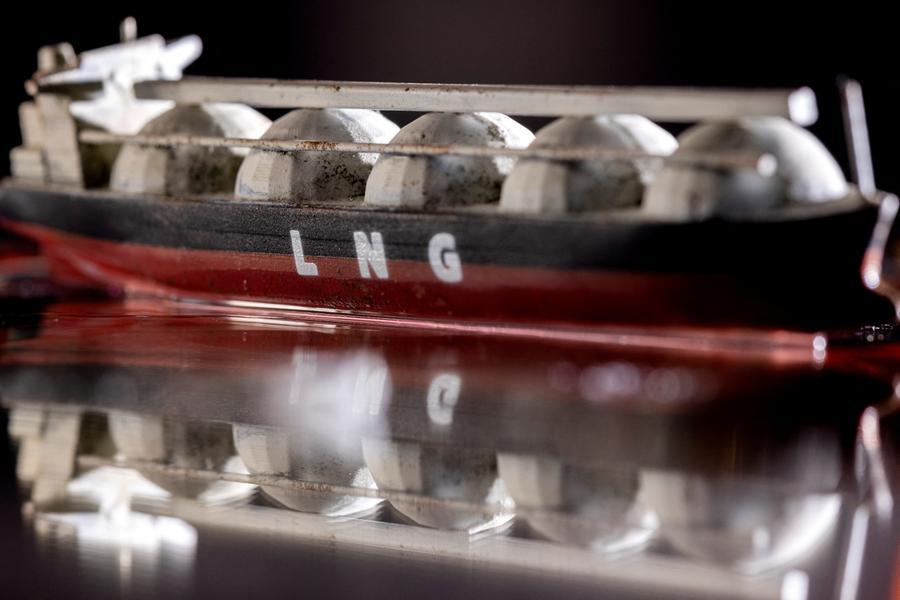

Venture Global LNG has reduced the valuation of its upcoming U.S. initial public offering (IPO) by almost half after potential investors expressed concerns over the company's long-term profitability in exporting liquefied natural gas (LNG). Originally seeking a valuation as high as $110 billion, Venture Global lowered its upper guidance to $65 billion. The Arlington, Virginia-based company, which is the second-largest exporter of LNG in the U.S., stands to benefit from policies expected to support oil and gas under President Donald Trump's administration. However, investors were wary about whether Venture Global could achieve earnings to justify the initial IPO price. The revised offering includes additional shares to fill the fundraising gap created by the lower valuation. The IPO aims to raise up to $1.9 billion, valuing the company among the top U.S. energy firms by market capitalization if priced at the upper range. The timing is strategic, coinciding with Trump's second term, during which oil and gas policies could be favorable. Despite these possibilities, ongoing litigation surrounding non-fulfilled long-term contracts clouds the IPO's future. Critics question the outcome, noting that the company could cancel the IPO if unfavorable valuations persist. Proceeds are intended for general corporate purposes and potential future LNG projects. Venture Global's expansion plans and dependence on external market factors illustrate both potential and inherent risks in this complex offering.

Sectors

- Energy

- Finance

- Legal

Geography

- United States – Venture Global operates as a major LNG exporter in the U.S. and the IPO is specifically a U.S. market event.

- Louisiana – Venture Global's LNG projects in development are located near the Gulf of Mexico in Louisiana.

Industry

- Energy – This industry is directly involved, focusing on liquefied natural gas (LNG) exportation, a critical component for companies like Venture Global.

- Finance – The context of an initial public offering (IPO) and associated valuations brings in significant financial industry considerations.

- Legal – Legal industry relevance is highlighted through ongoing litigation over delivery contracts involving major energy companies.

Financials

- $65.3 billion – Revised upper valuation estimate for Venture Global's IPO.

- $1.9 billion – Maximum capital expected to be raised through the IPO.

- $4.52 per MMBtu – Venture Global's expected earnings per million British thermal units, according to their IPO filing.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Venture Global LNG | Target company | Company | A major U.S. LNG exporter looking to go public through an IPO. |

| Cheniere Energy | Comparison company | Company | The largest U.S. LNG exporter and a benchmark for Venture Global's valuation. |

| Donald Trump Administration | Policy context | Government | The U.S. presidency provides an expected pro-oil and gas policy backdrop favorable to Venture Global. |

| Michael Sabel and Robert Pender | Founders | People | Co-founders of Venture Global LNG, involved in its rapid growth story. |

| BP, Shell, and Edison | Contract parties | Company | Major energy companies involved in litigation with Venture Global over LNG delivery contracts. |