TVS Capital Funds Reinvents Investment Strategy for the Future

Funding | Dec 13, 2024 | TVS Capital Funds Ltd

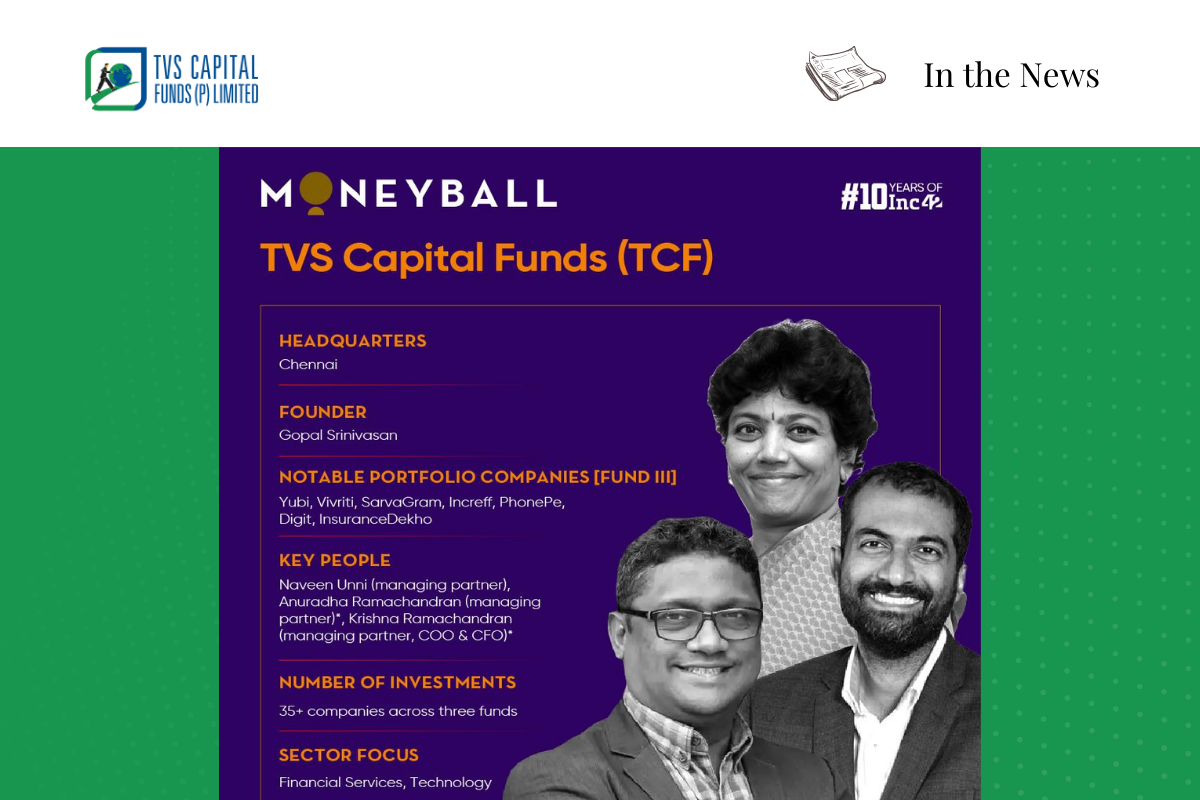

TVS Capital Funds Ltd., a pioneering private equity firm based in India and set up in 2007 by Gopal Srinivasan, is embracing a strategic transformation. Having deployed INR 3,000 Crore from three growth-focused PE funds, the firm is now preparing for its fourth fund after obtaining SEBI’s approval in January 2024. TCF has already raised INR 2,500 Crore out of the INR 3,000 Crore corpus, with an emphasis on the lucrative sectors of financial services and technology. The firm has evolved its investment thesis through its funds, initially being sector-agnostic, but later concentrating on the sectors it understands well, like financial services and tech-for-finance startups. The new strategy includes a multi-stage investment model emphasizing both early and late-stage startups. The firm has implemented a proprietary evaluation process known as the 1080 process, which includes extensive stakeholder interviews and comprehensive due diligence. With a focus on efficiency and innovation, TCF is integrating advanced technologies to streamline operations and enhance investment processes while maintaining its disciplined approach in the rapidly changing Indian startup ecosystem. The transformation is supported by a robust leadership and advisory team, and it aims to create multi-decadal businesses and drive high returns against market fluctuations.

Sectors

- Private Equity

- Financial Services

- Technology

Geography

- India – TVS Capital Funds is based in India, and its investments primarily target the Indian market, tapping into the country's diverse financial and technological sectors.

Industry

- Private Equity – TVS Capital Funds operates within the private equity sector, primarily focusing on growth investments and efficiently managing PE portfolios.

- Financial Services – The firm's recent focus on financial services reflects its investment in key sub-sectors such as lending, wealth management, and financial technology.

- Technology – A pivotal area of TCF's investments and tech integration aims to enhance operational efficiencies and underpin its transformational PE strategies.

Financials

- INR 3,000 Crore – Total corpus targeted for TCF's fourth fund.

- INR 2,500 Crore – Amount raised so far for TCF's fourth fund.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| TVS Capital Funds Ltd. | Private Equity Firm | Company | An India-based private equity firm founded in 2007, focusing on growth investments in financial services and technology sectors. |

| Gopal Srinivasan | Chairman | Person | Founder and Chairman of TVS Capital Funds, a third-generation entrepreneur from the TVS Group. |

| SEBI | Regulatory Authority | Government | India's Securities and Exchange Board of India that regulates securities and approves funds like TCF's AIF CAT II. |

| Krishna Ramachandran | Managing Partner, COO, CFO | Person | TCF's managing partner, overseeing operational and financial efficiency as part of the strategic transformation. |

| Anuradha Ramachandran | Managing Partner | Person | Leads investments and portfolio management in the financial services vertical at TCF. |

| Naveen Unni | Managing Partner | Person | Drives investments and manages portfolios in the technology sector at TCF. |

| Ravi Krishnan | VP of Finance | Person | Joined TCF strengthening their finance team. |