Tikehau Capital Acquires Control of JNG to Drive Growth in Sustainable Agriculture

Deal News | Mar 17, 2025 | Finance Community ES 2 - Corporate M&A

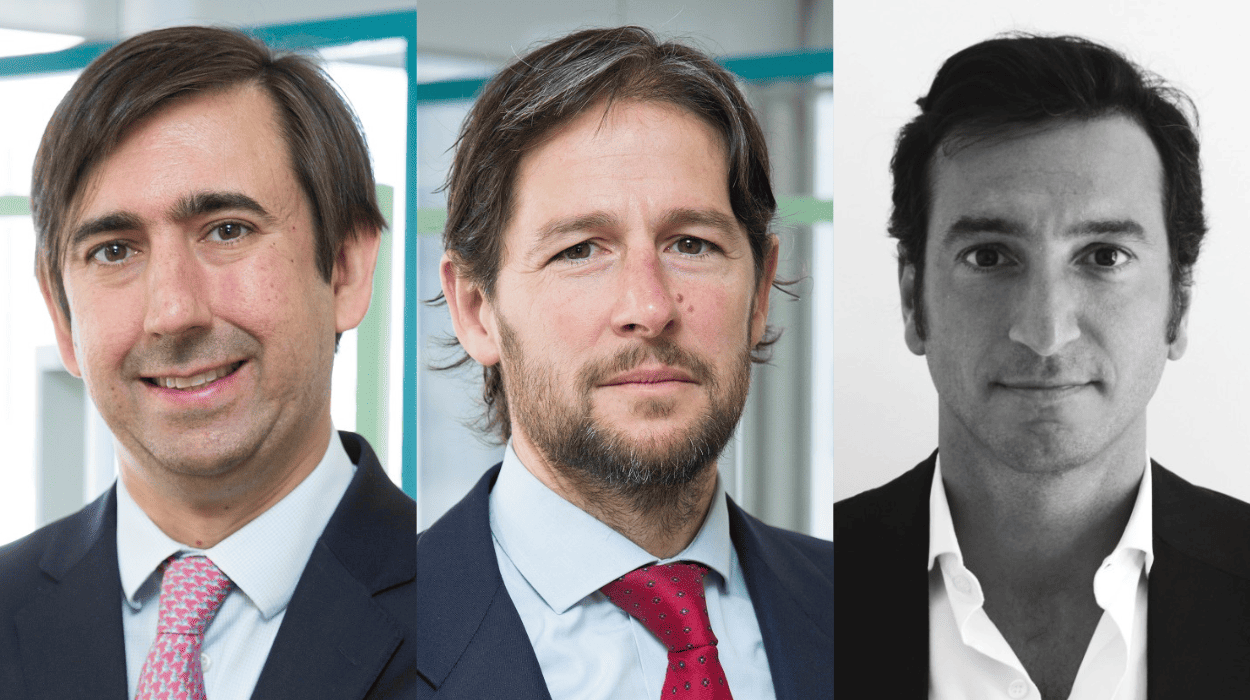

Tikehau Capital, a global alternative asset management group, has acquired a controlling interest in Juan Navarro García (JNG), a leading company known for the production and distribution of paprika and oleoresins. As part of this transaction, both Queka Real Partners and JNG's management team will invest alongside Tikehau Capital to support the company's international growth and development. The investment will be made through Tikehau Capital's private equity strategy focusing on regenerative agriculture, developed in collaboration with Unilever and AXA. This initiative aims to foster a more resilient and sustainable agro-food sector by backing companies that prioritize sustainability and the preservation of natural resources. The Tikehau Capital team involved in the transaction included David Martín, José María Mateu, and Marta Ramirez. Altamar Advisory Partners, led by Jaime Fernández-Pita and José Epalza, advised Tikehau Capital, while PwC conducted the due diligence. Queka Real Partners received advice from BBVA and LEK Consulting.

Sectors

- Private Equity

- Agriculture

- Sustainable Food & Agriculture

Geography

- Spain – Tikehau Capital's acquisition of Juan Navarro García (JNG), a Spanish company, indicates the geographical context of the transaction.

- Europe – The involvement of Tikehau Capital, headquartered in Paris, and advisory firms, including teams from across Europe, suggests a broader European cultural and economic relevance.

Industry

- Private Equity – Tikehau Capital's acquisition of a controlling stake in JNG is typical of private equity transactions, where investment firms acquire equity in companies to drive growth.

- Agriculture – JNG, the target company, is engaged in the production and distribution of agricultural products such as paprika and oleoresins, emphasizing the agricultural industry’s role in this deal.

- Sustainable Food & Agriculture – The focus on regenerative agriculture by Tikehau Capital, developed with Unilever and AXA, highlights the investment in sustainable food and agriculture practices.

Financials

- Not disclosed – The financial terms of the controlling acquisition by Tikehau Capital were not disclosed.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Tikehau Capital | Bidding Company | Company | A global alternative asset management group acquiring a controlling stake in JNG. |

| Juan Navarro García (JNG) | Target Company | Company | A leader in the production and distribution of paprika and oleoresins. |

| Queka Real Partners | Participant | Company | An investment firm participating in the transaction alongside Tikehau Capital. |

| Altamar Advisory Partners | Advisory | Company | Provided advisory services for Tikehau Capital during the transaction. |

| PricewaterhouseCoopers (PwC) | Due Diligence | Company | Conducted the due diligence for Tikehau Capital in the acquisition of JNG. |

| BBVA | Advisory | Company | Provided advisory services to Queka Real Partners during the transaction. |

| LEK Consulting | Advisory | Company | Provided additional advisory services to Queka Real Partners in the deal. |

| David Martín | Managing Director | Person | A managing director and co-head of Iberia at Tikehau Capital involved in the transaction. |

| José María Mateu | Director | Person | A director at Tikehau Capital who was involved in the transaction. |

| Marta Ramirez | Vice President | Person | A vice president at Tikehau Capital, part of the team that worked on the acquisition. |

| Jaime Fernández-Pita | Managing Partner | Person | A managing partner at Altamar Advisory Partners, leading team advising Tikehau Capital. |

| José Epalza | Managing Partner | Person | Another managing partner at Altamar Advisory Partners involved in the advisory team. |

| Antton Ranedo | Associate | Person | An associate at Altamar Advisory Partners involved in advising Tikehau Capital. |

| Álvaro Elio Dolz de Espejo | Managing Director | Person | A managing director at BBVA, led the advisory services for Queka Real Partners. |