Saudi Venture Capital Fuels Growth with $150M Investment in MEVP's Fund

Funding | Dec 16, 2024 | Zawya

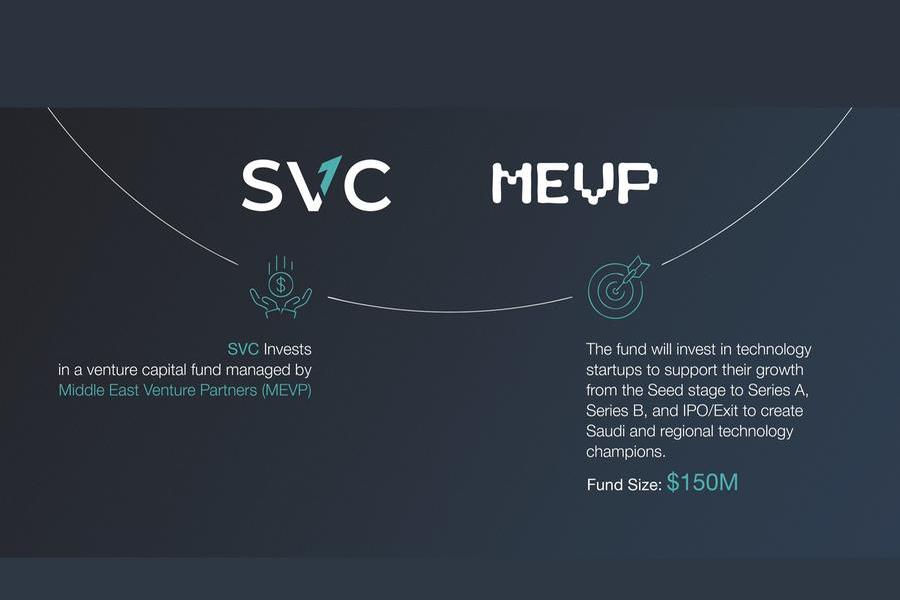

Saudi Venture Capital (SVC) has announced an investment in the Middle East Venture Fund IV, a $150 million venture capital fund managed by Middle East Venture Partners (MEVP). The fund’s objective is to foster technology startups in Saudi Arabia, supporting them from their inception through various growth stages up to potential IPOs or exits. SVC, a subsidiary of the SME Bank and part of the National Development Fund, aims to stimulate long-term financial support for startups and SMEs across Saudi Arabia. MEVP is a formidable player in the MENA region, with a sizable investment footprint, having already propelled several local startups into success. This strategic investment aligns with SVC's goals of nurturing early-stage companies to create significant economic and social impacts within the Kingdom. Additionally, MEVP’s historical achievement of creating high-quality jobs and attracting substantial foreign investment into Saudi Arabia underscores the potential benefits of this partnership. With more than 60 portfolio companies and a vast network across MENA, Sub-Saharan Africa, Pakistan, and Turkey, MEVP is well-positioned to drive significant growth and innovation in the region.

Sectors

- Venture Capital

- Technology

Geography

- Saudi Arabia – The primary focus is on supporting technology startups within Saudi Arabia and enhancing the domestic economy.

- Middle East and North Africa (MENA) – Middle East Venture Partners operates in the MENA region, making it a significant geographical area for the investment.

Industry

- Venture Capital – The article focuses on the investment in a venture capital fund by Saudi Venture Capital in collaboration with Middle East Venture Partners.

- Technology – The investment is targeted at technology startups in Saudi Arabia with high growth potential.

Financials

- $150 million – The size of the Middle East Venture Fund IV, into which SVC has invested.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Saudi Venture Capital (SVC) | Investor | Company | A subsidiary of the SME Bank and part of the National Development Fund, SVC focuses on stimulating financing for startups and SMEs. |

| Middle East Venture Partners (MEVP) | Fund Manager | Company | A pioneering venture capital firm managing several technology-focused funds in the MENA region. |

| Dr. Nabeel Koshak | CEO and Board Member of SVC | Person | Spokesperson for SVC, involved in the investment announcement. |

| Walid Mansour | Co-Founder and Co-CEO of MEVP | Person | Spokesperson for MEVP, providing insights into the fund's objectives and potential impacts. |