Ridgemar: Strategic Expansion in Eagle Ford as Crescent Completes Acquisition for $905 Million

Deal News | Feb 04, 2025 | EIN

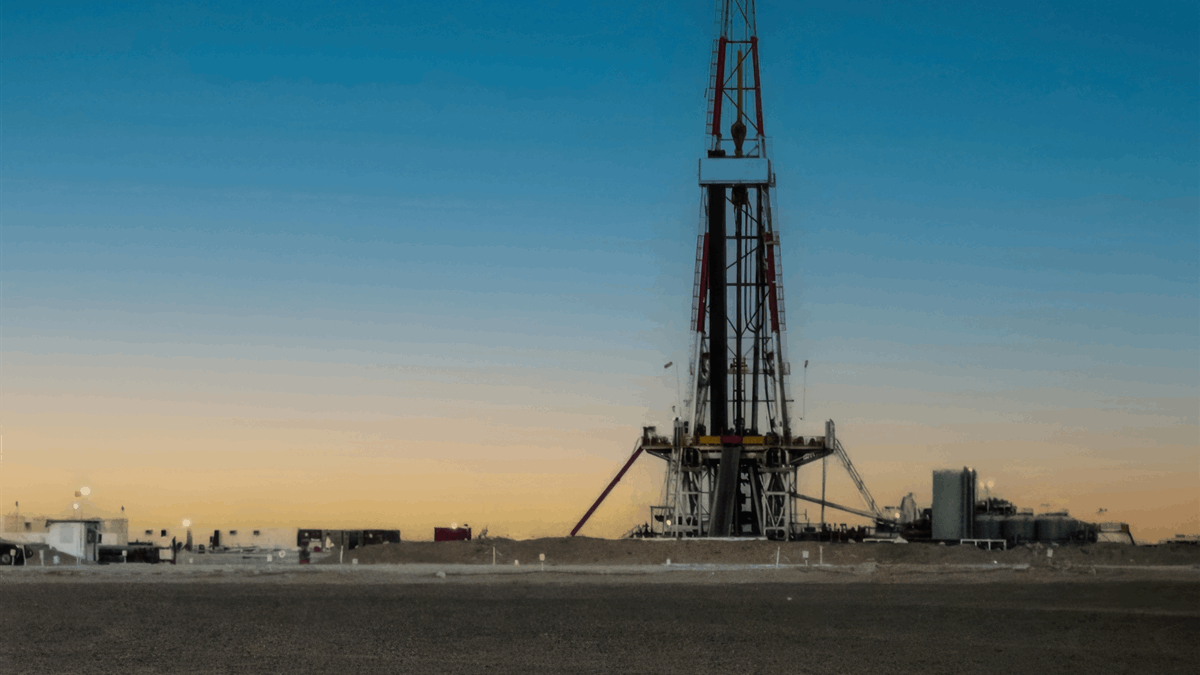

Crescent Energy Co. has completed its acquisition of Ridgemar (Eagle Ford) LLC for $905 million, thereby expanding its operations extensively within the Texas Eagle Ford shale region. According to Crescent's CEO David Rockecharlie, this purchase represents a crucial step toward achieving the company's strategy of shareholder value accrual through disciplined investments. The deal, which positions Crescent favorably with approximately 20 Mboe/d of oil production and a strengthened inventory, is valued at 2.7x EBITDA. It includes an upfront payment of $830 million in cash and shares, coupled with contingent payments based on WTI oil prices. Crescent financed the acquisition partly through a $400 million senior note issuance. Jefferies LLC advised Crescent while RBC Capital Markets LLC represented Ridgemar. The effort is part of Crescent's greater strategic move within Eagle Ford, having completed more than $4 billion in M&A transactions over 18 months.

Sectors

- Oil and Gas Exploration & Production

- Mergers & Acquisitions Advisory

Geography

- United States – The transaction takes place in the United States, specifically focusing on the Texas Eagle Ford shale, with both Crescent Energy and Ridgemar based in Houston, Texas.

Industry

- Oil and Gas Exploration & Production – The article involves Crescent Energy Co., which operates in the exploration and production of oil and gas, specifically within the Eagle Ford shale region.

- Mergers & Acquisitions Advisory – The article discusses a corporate acquisition transaction, involving financial and legal advisory services from firms like Jefferies LLC and Kirkland & Ellis LLP.

Financials

- 905 million USD – Total value of the acquisition deal between Crescent Energy and Ridgemar (Eagle Ford) LLC.

- 830 million USD – Upfront cash and stock payment made by Crescent Energy for the acquisition.

- 170 million USD – Contingent consideration based on future oil prices as part of the acquisition agreement.

- 400 million USD – Amount of new senior notes issued by Crescent Energy to finance the transaction.

- 2.7x EBITDA – Valuation multiple for the transaction.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Crescent Energy Co. | Buyer | Company | A Houston-based company involved in oil and gas exploration and production, particularly active in the Eagle Ford and Uinta Basin regions. |

| Ridgemar (Eagle Ford) LLC | Target Company | Company | A company operating in the Eagle Ford shale, which has been acquired by Crescent Energy Co. |

| Jefferies LLC | Financial Advisor to Crescent | Company | Provided financial advisory services to Crescent Energy Co. during the acquisition of Ridgemar. |

| Kirkland & Ellis LLP | Legal Counsel to Crescent | Company | Provided legal advisory services to Crescent Energy Co. for the transaction. |

| RBC Capital Markets LLC | Financial Advisor to Ridgemar | Company | Acted as the financial advisor to Ridgemar in the acquisition by Crescent Energy Co. |

| Vinson & Elkins LLP | Legal Counsel to Ridgemar | Company | Provided legal advisory services to Ridgemar for the transaction. |