Q5D Secures £10 Million Investment Led by SWIF Maven Equity Finance

Deal News | Jun 10, 2025 | Maven Capital Partners

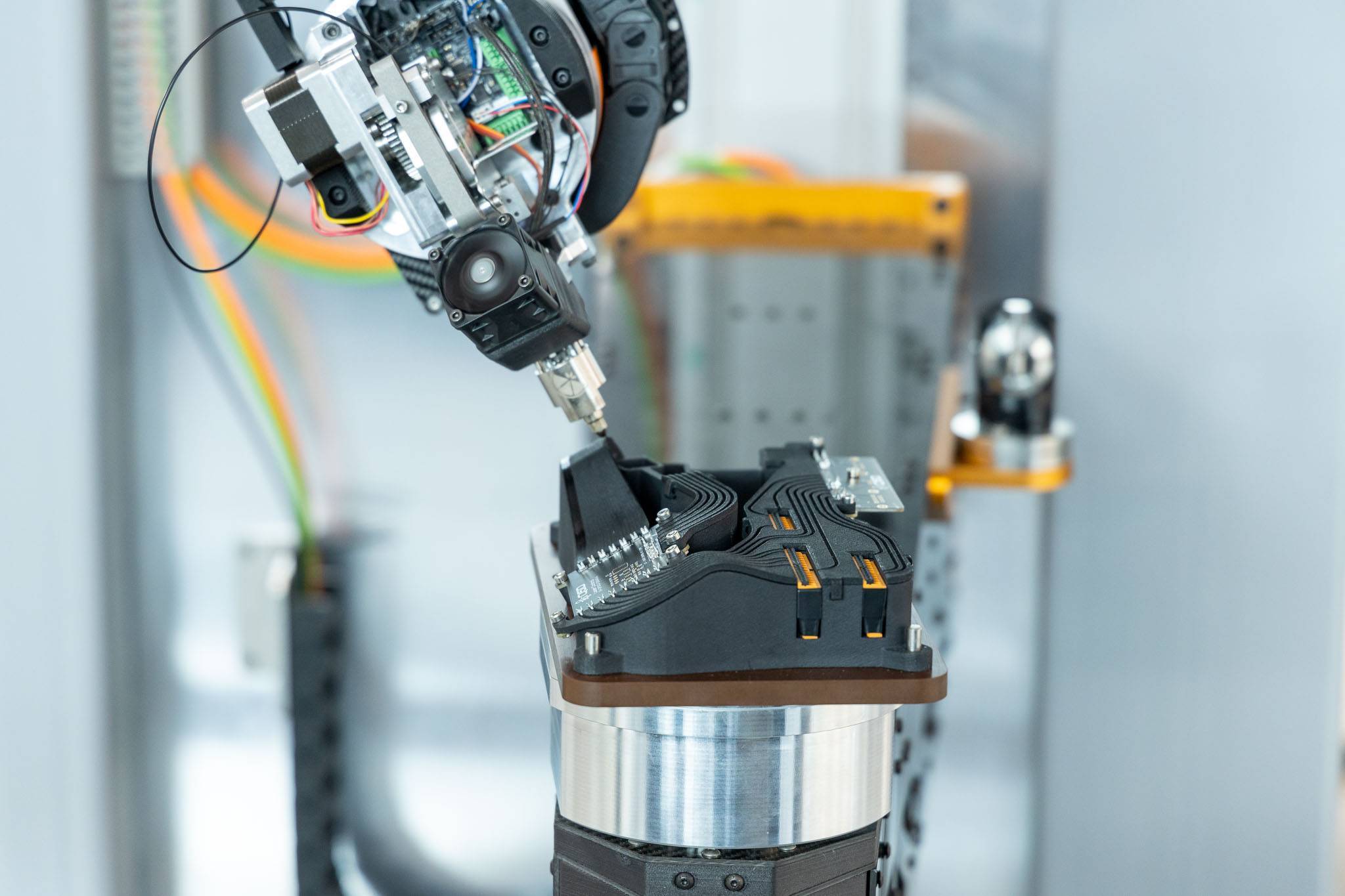

UK-based PE firm Maven Capital Partners, through its SWIF Maven Equity Finance fund, has participated in a £10 million funding round for Q5D Technologies. The investment supports Q5D's innovative approach to automating the manual assembly of wiring harnesses, a critical bottleneck in industries like automotive and aerospace. Q5D's robotic cells enhance productivity by integrating wiring into the structure of products, simplifying supply chains amidst global trade uncertainties. This fresh capital injection will aid in commercial pilots, team expansion, and increased manufacturing capacity, moving towards full-scale application. Maven, alongside other investors such as Lockheed Martin Ventures and Chrysalix, aims to foster significant advancements in manufacturing efficiency and electrification. The investment signifies a strategic push in the South West of England's advanced manufacturing sector, creating high-value jobs and furthering innovative solutions.

Sectors

- Manufacturing Technology

- Private Equity

- Automotive

Geography

- United Kingdom – The investment and the technology development are based in the UK, with specific mention of locations such as Bristol and Portishead.

Industry

- Manufacturing Technology – The article discusses the development of advanced manufacturing techniques in the wiring assembly process, a fundamental innovation in the manufacturing technology sector.

- Private Equity – Maven Capital Partners, a private equity firm, is a key player in this investment, representing their ongoing support for innovative technology companies.

- Automotive – Q5D's robotic technology is particularly pertinent to the automotive industry, aiming to streamline the manufacturing process of wiring harnesses used in vehicles.

Financials

- £10,000,000 – Total fundraise amount for Q5D Technologies.

- £8,000,000 – Investment amount co-led by Lockheed Martin Ventures, Chrysalix, and Maven.

- £2,000,000 – Investment amount from Innovate UK.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Q5D Technologies | Target company | Company | Q5D Technologies is innovating with 5-axis robotic cells that automate the assembly of wiring harnesses. |

| Maven Capital Partners | Investing Private Equity firm | Company | Maven Capital Partners is a private equity firm investing through its SWIF Maven Equity Finance fund to support innovative companies in the UK. |

| Lockheed Martin Ventures | Co-investor | Company | Lockheed Martin Ventures is a venture capital fund supporting innovation in technology-driven sectors. |

| Chrysalix | Co-investor | Company | Chrysalix is a venture capital firm investing in resource efficiency and advanced industry innovation. |

| Stephen Bennington | CEO of Q5D Technologies | Person | Stephen Bennington is the CEO, driving Q5D Technologies' growth and development strategy. |

| Innovate UK | Investor | Government | Innovate UK is a government body providing innovation funding in the UK. |

| Melanie Goward | Partner at Maven Capital Partners | Person | Melanie Goward is involved in the investment and growth strategy at Maven Capital Partners. |

| Lizzy Upton | Senior Investment Manager at British Business Bank | Person | As a manager at British Business Bank, Lizzy Upton supports the investment in Q5D Technologies through strategic funding. |