Knight Corporate Finance Leads The Year With 12 Stellar Deals

Deal News | Dec 19, 2024 | Knight Corporate Finance

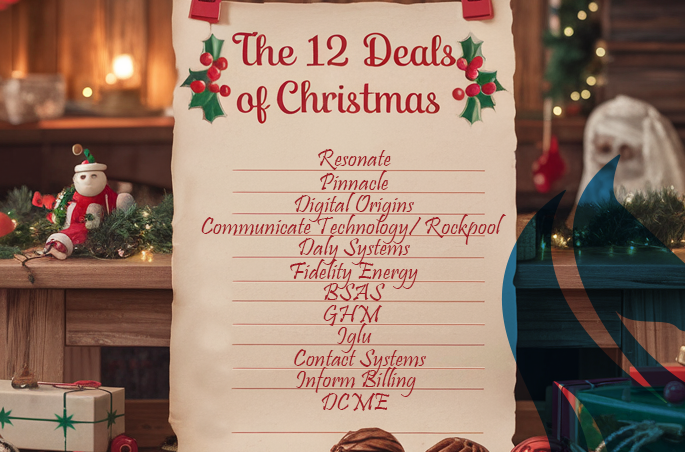

Knight Corporate Finance reflects on a remarkable year of success in 2024, highlighting the expertise and strategic prowess of its Corporate Finance team. Celebrated as 'The 12 Deals of Christmas', these accomplishments demonstrate the team's capability in handling diverse transactions, from private equity buy-sides to debt fund raises. The team showcased their agility and efficiency in the sale of Pinnacle, a UC reseller, and their meticulous preparation in orchestrating the successful sale of Resonate to SCC. Notably, Knight's capability in nurturing long-term client relationships was evidenced in deals with Digital Origins and Contact Systems. Additionally, a complex transaction involving Communicate Technology, Rockpool, and York Data Services highlighted the team's proficiency in multi-faceted engagements. The firm also successfully facilitated a private equity sell-side deal involving Fidelity Energy's MBO with Blixt. As they expanded their market presence to new sectors, Knight's adaptability shone through in the health technology sector with DCME and a strategic investment from Agilio. Knight’s achievements underscore their dedication and commitment to excellence, setting the stage for future successes.

Sectors

- Corporate Finance

- Private Equity

- ICT Sector

Geography

- United Kingdom – Most of the advisory and transactional activities seem to be concentrated in the UK, as implied by the companies involved.

- United States – US-based Evergreen's acquisition in one of the deals highlights a geographical tie with the US.

Industry

- Corporate Finance – The article focuses on the corporate finance team's success in finalizing a variety of transactions and deals.

- Private Equity – Several of the deals mentioned involve private equity transactions, highlighting the firm's expertise in this sector.

- ICT Sector – Many of the deals are within the ICT sector, indicating the team's specific focus and expertise.

Financials

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Knight Corporate Finance | Advisor | Company | Provided advisory services in various transactions including buy-sides, sell-sides, and debt fund raises. |

| SCC | Buyer | Company | Acquired Resonate, the Teams integration specialist. |

| Focus Group | Buyer | Company | Acquired Pinnacle, a UC reseller, as well as Contact Systems, a CCaaS provider. |

| Evergreen | Buyer | Company | US-based company acquired Digital Origins, expanding its market reach. |

| SCG | Buyer | Company | Acquired both BSAS and GHM, illustrating its expansion strategy. |

| Blixt | Buyer | Company | Conducted an MBO on Fidelity Energy as part of a private equity transaction. |

| K3 Advantage | Partner | Company | Joint mandate with Knight Corporate Finance, resulting in debt funding from Triple Point for Iglu. |

| Giacom | Buyer | Company | Acquired Inform Billing, enhancing its market position. |

| Agilio | Investor | Company | Made a strategic investment in DCME, marking Knight's entry into the health technology sector. |

| OneCom | Partner | Company | Collaborated with Knight Corporate Finance in advising Daly Systems on their sale. |