Blaize Goes Public via $1.2B SPAC Merger

Deal News | Jan 15, 2025 | EIN

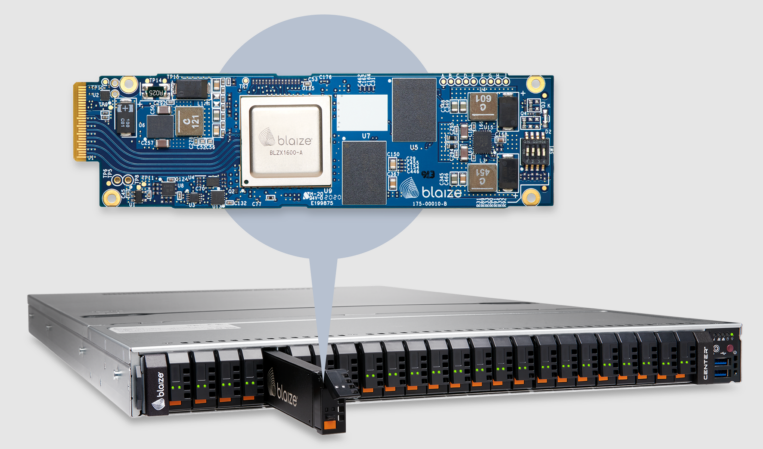

Blaize Holdings Inc., an AI chip startup known for its power-efficient processors, has announced its decision to go public through a SPAC merger on the Nasdaq. The particular SPAC involved is BurTech Acquisition Corp., owned by Burkhan World Investments. This deal places Blaize's valuation at $1.2 billion and provides a $116 million convertible note with an additional $36 million pending. Blaize, based in El Dorado Hills, CA, has previously raised over $300 million from investors including Samsung. The firm's flagship product, the Blaize 1600 system-on-chip, is optimized for machine learning and other workloads. Despite a financial loss of $87.6 million against $3.8 million in revenue last year, Blaize anticipates increased sales through strategic customer deals in various sectors, including a $104 million purchase order from an EMEA defense entity. Newly public, Blaize aims to diversify its product offerings and partner with hardware manufacturers to bolster market presence.

Sectors

- Semiconductors

- Artificial Intelligence

- Automotive

Geography

- United States – Blaize Holdings Inc. is based in El Dorado Hills, California.

- EMEA – Blaize has received a significant purchase order from an unnamed defense entity in the EMEA region.

- Japan – Blaize has a partnership with Denso Corp., a major Japanese auto parts supplier.

Industry

- Semiconductors – Blaize operates within the semiconductor industry, specifically developing advanced AI chips optimized for machine learning workloads.

- Artificial Intelligence – Blaize develops AI chips and software solutions, focusing on power-efficient AI model processing.

- Automotive – Blaize collaborates with automotive companies like Denso and Mercedes-Benz, indicating its involvement in related AI applications.

Financials

- $1.2 billion – The valuation of Blaize in the SPAC merger deal.

- $116 million – Convertible note that Blaize will gain access to through the SPAC merger.

- $36 million – Additional funding planned upon the completion of the SPAC transaction.

- $87.6 million – Blaize's reported loss for the year ending December 31, 2023.

- $3.8 million – Blaize's revenue for the year ending December 31, 2023.

- $104 million – Value of a signed purchase order from an EMEA defense entity.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Blaize Holdings Inc. | Target Company | Company | A company developing power-efficient AI chips, now going public through a SPAC merger. |

| BurTech Acquisition Corp. | Bidding Company | Company | The SPAC used for Blaize’s public listing, owned by Burkhan World Investments. |

| Samsung Electronics Co., Ltd. | Investor | Company | One of the investors in Blaize, having previously contributed significant capital. |

| Denso Corp. | Partner | Company | A major auto parts supplier partnered with Blaize in automotive applications. |

| Mercedes-Benz | Partner | Company | Collaborated with Blaize on the development of a partly autonomous driving system. |

| Burkhan World Investments | Owner of SPAC | Company | Owns BurTech Acquisition Corp., the entity facilitating Blaize's transition to a public company. |