Binance's $2bn Boost from MGX: A Highlight in Crypto VC Rebound

Deal News | May 01, 2025 | Galaxy Digital LP

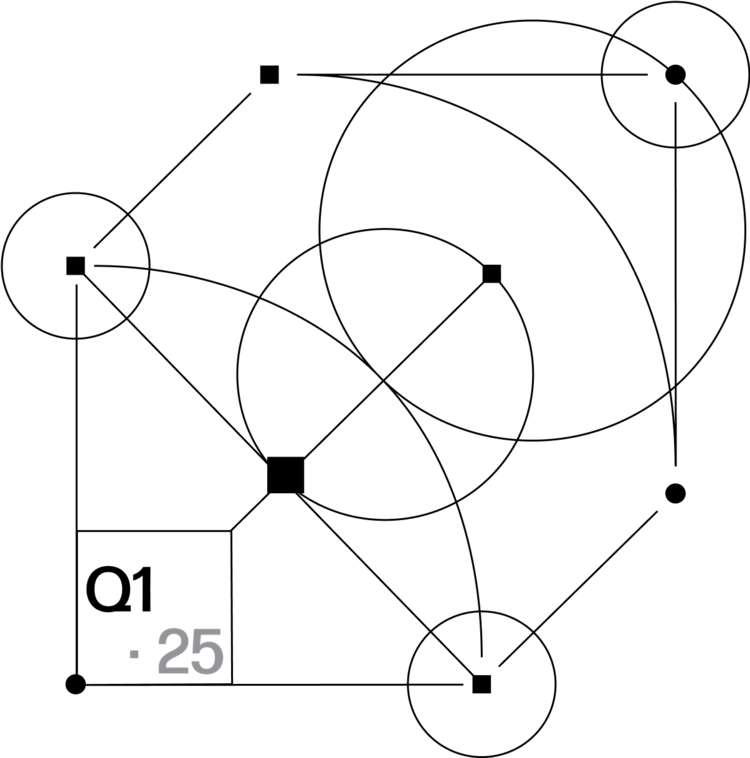

The first quarter of 2025 saw crypto venture capital investment at its highest since the third quarter of 2022, amounting to $4.9 billion across 446 deals, marking a 40% increase in capital and a 7% increase in deal count quarter-over-quarter. Despite the evident interest, a significant portion of this investment was attributable to a single sovereign wealth fund from Abu Dhabi, MGX, which invested $2 billion in Binance. This investment skewed the data such that, excluding it, total investments would be at $2.8 billion, a decrease from the previous quarter. The majority of these investments, for the first time since 2020, were directed at later-stage companies, reflecting the maturing crypto market. While Bitcoin-centered activities are thriving, other altcoins and blockchain elements are not sustaining the pace, primarily due to macroeconomic concerns and the allure of other tech sectors like AI. The U.S. remains the dominant geographic location for deals, holding a substantial share of global crypto VC activity, with a noteworthy shift towards later-stage companies that might edge out the once flourishing pre-seed investments. A resurgence in interest from institutional players and the enacting of more crypto-friendly U.S. policies could solidify this trend further.

Sectors

- Cryptocurrency

- Venture Capital

- Blockchain Technology

Geography

- United States – The U.S. dominates venture capital deals in crypto, reflecting its pivotal role despite regulatory challenges.

- United Arab Emirates – MGX, a UAE-based fund, was central to the largest investment at Binance, highlighting the country's influence in crypto funding.

- Malta – Headquarters of Binance, which received the largest investment, making Malta the leading location for capital invested in this period.

Industry

- Cryptocurrency – The article discusses significant investment activities in the cryptocurrency sector, highlighting major players and funding developments.

- Venture Capital – It explores venture capital funding trends within the cryptocurrency ecosystem, indicating shifts in investment targets and stages.

- Blockchain Technology – Investments are discussed concerning blockchain infrastructure and tokenization, which are integral parts of this industry.

Financials

- $4.9 billion – Total venture capital investment in crypto startups for Q1 2025.

- $2 billion – Investment amount from MGX to Binance, representing a significant portion of total capital invested.

- $1.9 billion – Funds allocated to new crypto venture funds in Q1 2025.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Galaxy Digital LP | Observer | Company | Provides analysis and commentary on the current state of crypto venture capital market trends. |

| MGX | Investor | Company | A sovereign wealth fund connected to Abu Dhabi, responsible for a $2bn investment in Binance. |

| Binance | Fundraising Target | Company | A major cryptocurrency exchange receiving the largest investment in Q1 2025. |