Bangladesh Bank Plans Merger for Islamic Banks and NBFIs

Deal News | May 27, 2025 | EIN

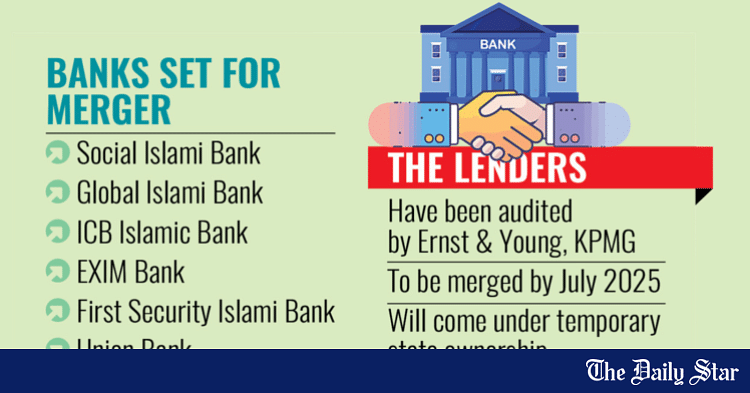

In an ambitious move, Bangladesh Bank (BB) is set to launch a merger initiative targeting financially troubled banks and non-bank financial institutions (NBFIs) under the new Bank Resolution Ordinance. Initially, six Islamic banks, including Social Islami Bank, Global Islami Bank, and others, will be merged to stabilize the banking sector, following asset quality reviews by Ernst & Young and KPMG. The process will commence with nationalizing banks temporarily to assure depositors' funds are safeguarded. Simultaneously, BB is tightening regulations on NBFIs, with 20 institutions asked to justify why their licenses should not be revoked amidst high default rates. The central bank's strategy aims to restore confidence and improve financial stability amid challenges in the sector.

Sectors

- Banking & Financial Services

- Auditing & Consultancy

Geography

- Bangladesh – The article is focused on the financial sector within Bangladesh, where the Bangladesh Bank is initiating merger plans for banks and NBFIs.

Industry

- Banking & Financial Services – This industry is involved as the article discusses mergers among banks and non-bank financial institutions in Bangladesh.

- Auditing & Consultancy – This sector is relevant due to the involvement of Ernst & Young and KPMG in conducting asset quality reviews for the banks.

Financials

- Tk 25,089 crore – The total defaulted loans by 35 NBFIs as of December last year.

- 33.25% – Percentage of total disbursed loans that are defaulted in the NBFI sector as of December last year.

- 99% – Default loan rate for FAS Finance, the highest among the NBFIs mentioned.

Participants

| Name | Role | Type | Description |

|---|---|---|---|

| Bangladesh Bank | Initiator of Merger Plan | Government | The central bank of Bangladesh implementing merger strategies for financial stability. |

| Social Islami Bank | Target for Merger | Company | One of the Islamic banks identified for merging under BB's plan. |

| Global Islami Bank | Target for Merger | Company | An Islamic bank listed for merger due to financial instability. |

| ICB Islamic Bank | Target for Merger | Company | Included in the merger initiative for financially weak banks. |

| EXIM Bank | Target for Merger | Company | Identified by BB for the merger strategy among Islamic banks. |

| First Security Islami Bank | Target for Merger | Company | One of the six Islamic banks targeted for mergers. |

| Union Bank | Target for Merger | Company | Part of the merger plan due to financial challenges. |

| Ernst & Young | Audit Firm | Company | Conducted asset quality reviews for the Islamic banks. |

| KPMG | Audit Firm | Company | Engaged in asset quality reviews for the merger plan. |

| FAS Finance | Troubled NBFI | Company | One of the NBFIs with a high default rate facing possible consequences under BB's plan. |

| Ahsan H Mansur | Governor of Bangladesh Bank | Person | The governor of Bangladesh Bank who announced the merger plan. |